DJI30:

I will start my review with the my context on DJ30. The weekly chart shows the momentum failed to reach the sustainable bear zone. This tells me that the ATH high is either an end of an impulse wave or rather it's an intermediate degree wave (B) of primary [4] (not shown on the chart).

|

| DJI30 (CFD) - weekly chart |

The smaller rectangle drawn up I call it critical structural EWP support zone because this is the limit of a wave c within a flat pattern. So my plan for next week that above this level I will think of this recent price action as part of a flat correction until the market proves it otherwise. If this 1st zone will fail to provide decent support and the smaller corrective channel (shown on the weekly chart) gets broken then I start to think of a trend reversal and anticipating a wave (C) of [4] to unfold (in either an ABC or an impulse structure). My target then will be the next support zone.

|

| DJI30 (CFD) - Daily chart |

The momentum of the daily time frame and below nicely set this breakdown. Th RSI on the daily, 4 hours and 1 hour charts pull backed to a level where a breakdown can be anticipated. This break down got confirmed on 1 and 4 hours time frames. It is crucial that the price reach the 161.8 expansion level, which is the minimum requirement for an impulse wave in my reading. If this level gets reached then a small pause (correction) might come, but it is not necessary. This is just a thought so far. I won't dare to change it if the market will throw something else on the table...

|

| DJI30 (CFD) - 4 hours chart |

|

| DJI30 (CFD) - 1 hour chart |

DAX30:

The market almost reached the top of my target zone with closing candle on Friday night (during the last trading hour of the week a nice bearish slingshot got triggered on the 15 minutes chart).

The weekly and daily chart suggest it is still wiser to consider this drop as part of a range. I can draw up the parallel channel on weekly chart in two ways, but one thing would be the same: the market is at (pierced or at least neared) the higher line of this channel. This channel naturally works as a resistance. So my expectation of a ranging market on this time frames proved to be a good idea. The momentum here still only shows that I can j

ust anticipate a breakdown on these time frames. I need more confirmation for thinking to hit lower targets.

|

| DAX30 (CFD) -weekly chart |

|

|

| DAX30 (CFD) -.daily chart |

|

So right now I only expect that most likely a flat c wave will unfold. The ideal end for wave [3] of c would be at 10350. This is what the most likely scenario in my reading right now based on the 4 hours time frame and below. This 10350 level is also the maximum limit for an ABC pattern too. So above that I can't rule out a different corrective pattern (like a triangle), but below this level at least and impulse c wave can be expected. What's interesting that right now and idealized impulse wave structure would pretty much point to the lower line of a flat pattern corrective channel. I think that during most of the Monday session the MA10/20 channel shown on the 15 minutes chart will behave as resistance and will push the price lower nearing the 10350 level.

|

| DAX30 (CFD) - 4 hours chart | |

|

| DAX30 (CFD) - 15minutes chart |

I can draw up precisely a wave count for an impulse wave from the top on a 4 hours chart, but right now I feel like it would a waist of time. It can be charted as a wave i-ii-[1]-[2], but right now I don't feel the need for charting every little wave, especially because the market is still within the range.

|

| DAX30 (CFD) - 4 hours chart with alternate wave count |

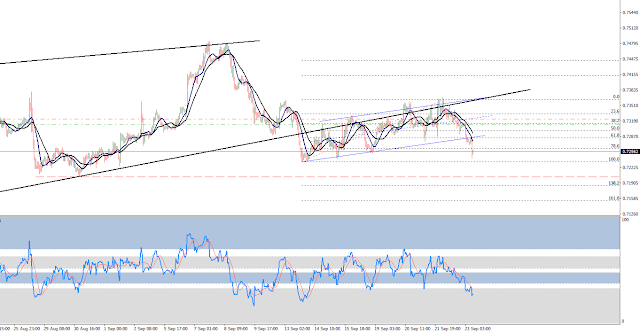

NZDUSD: